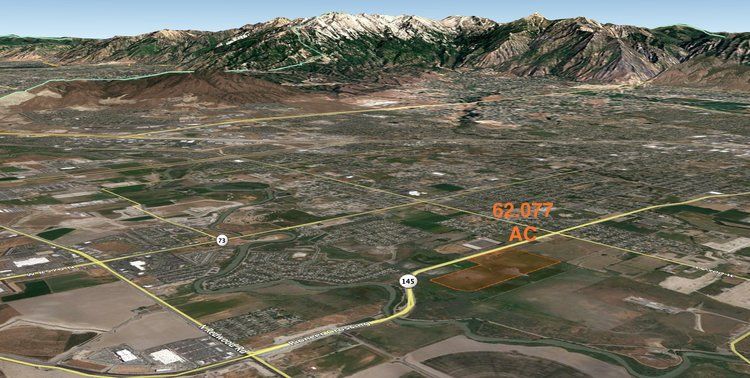

img courtesy: https://www.svngilmoreauction.com/auctions/detail/bw51926

I know it might seem like an oxymoron to “save government” as according to many we should do the opposite, but only fools believe we don’t need any oversight or governing enterprise for the good of the people.

Anarchists will tell you the only good government is a non-existent government and I disagree to the extent, it’s just not possible if you’re going to compete against a tidal wave of military infrastructure the world over. And anyone who says otherwise is simply not educated enough.

What we can do is help shrink government assets by selling those assets to reduce government debt, alleivate interest on debt, and focus on maximizing GDP to pension ratios. I’ve done this using LLM models that work in real time to sell assets of government departments, legally of course for their benefit, with the math to back it up.

The U.S. government owns or administers approximately 640 to 650 million acres of land nationwide. This represents nearly one-third of all U.S. land and is managed primarily by agencies such as:

-

Bureau of Land Management (BLM) – the largest single land owner with about 248 million acres.

-

U.S. Forest Service (USFS) – manages about 193 million acres.

-

Fish and Wildlife Service (FWS) – about 89 million acres.

-

National Park Service (NPS) – about 80 million acres.

-

Department of Defense (DOD) – about 11 million acres

I’ve done my share in saving the government millions in tooling costs.

Now, don’t get me wrong there are tons of models out there using LLM, or A.I. systems to evaluate and reduce waste expenditure, while incentivizing budget management adherence. Today we focus on the Department of Transportations asset portfolio to see what kind of waste we can eliminate there and how that would clone to other departments for maintaining debt interest resolution.

What that simply means is we’re not going to dial down the $34T debt without selling assets and refining employee expenditure. Yes, yes, that automatically equates to lost jobs, but that’s going to happen anyway due to LLM so get over it, there’s nothing anyone can do to stop technology progress since the stone age.

Based on the most recent U.S. Department of Transportation (DOT) Capital Planning Document for Real Property covering fiscal years 2021 to 2025, here is a partial breakdown of DOT’s real estate holdings:

Real Estate Holdings Details

-

Total number of real property assets: Over 370,000 across all DOT Operating Administrations (OAs).

-

The Federal Aviation Administration (FAA) is the largest holder, managing about 49,928 assets, which include FAA-owned, FAA-leased, GSA-owned, GSA-leased, and federally owned but FAA-controlled assets.

-

The Maritime Administration (MARAD) and other OAs also hold significant real property assets independently of the General Services Administration (GSA).

-

DOT’s real property inventory spans 16 federal real property profile usage categories, including office, warehouse, specialized mission spaces such as schools/training (2.7%), labs (4.7%), navigation and traffic aids (33%), among others.

-

DOT’s space management involves coordination with GSA for leased space acquisitions and disposals, as well as internal policies for FAA and MARAD due to their unique mission requirements.

-

All real property acquisitions, disposals, and leases are managed under rigorous governance involving senior officials in OST and individual OAs.

The U.S. Department of Transportation (DOT) has requested a total budget of approximately $147.1 billion for fiscal year 2026. This budget request includes $111.3 billion in new budgetary resources plus $35.8 billion in advance appropriations from the Infrastructure Investment and Jobs Act (IIJA) of 2021. Key highlights include significant funding boosts for key programs such as:

-

$27 billion total for the Federal Aviation Administration (FAA), including $22 billion for operations and infrastructure, with earmarks for hiring air traffic controllers and radar modernization.

-

Additional funding for the Federal Highway Administration’s Bridge Investment Program and the Federal Transit Administration’s Capital Investment Grants program.

-

Various adjustments and reallocations concerning rail infrastructure and electric vehicle charger programs.

The DOT 2026 Executive Summary: DOT_FY_2026_Budget_Highlights_508c

The FY 2026 President’s Budget requests $111.3 billion in new budgetary resources

for the Department of Transportation (DOT). When combined with $35.8 billion in

advance appropriations provided from the Infrastructure Investment and Jobs Act (IIJA),

the Department’s FY 2026 budget total is $147.1 billion.

The request focuses on supporting DOT’s core safety mission while also investing in big,

beautiful transportation infrastructure.

• $1.5 billion increase in new discretionary budget authority for a total of $27 billion,

a nearly six percent increase from FY 2025 enacted.

• A historic $22 billion investment in Federal Aviation Administration (FAA)

operations and infrastructure, including funding to hire up to 2,500 new air traffic

controllers, and an $824 million increase for FAA Facilities and Equipment,

including $450 million for radar modernization.

• $1.5 billion for the Maritime Administration (MARAD) to support key priorities

in the President’s Executive Order 14269, Restoring America’s Maritime Dominance,

including $550 million for the Port Infrastructure Development Program (PIDP) and

$105 million for Assistance to Small Shipyards.

• $2.3 billion for the Infrastructure for Rebuilding America (INFRA) grant program—

an increase of $770 million from FY 2025 enacted—to advance the President’s

infrastructure priorities.

• $500 million for the Consolidated Rail Infrastructure and Safety Improvements

(CRISI) grant program, a $400 million increase over FY 2025 enacted.

• Proposed cancellation of approximately $5.7 billion in IIJA funding for wasteful

and ineffective electric vehicle (EV) charger programs.

Ok as we can see the only shrinkage on a large scale is eliminating less than $10B, while the department continues to grow assets and employees, which is completely stupid, irresponsible, and should really tell you that fiscal managers are simply out of touch with the times and need to be replaced.

In real esate assets alone if we sold off a mere 10,000 properties out of the dang near 400K, we could allocate an additional $10B in savings to the DOT.

If we advance asset sales to just six other departments we could raise an additional $70-80B. All in all, with tooling cost adjustment and sale of real estate assets – we can easily generate $100B.

Moreover this would energize manufacturing and commercial real estate projects for the economy. The data is a positive across the board and would bolster market confidence.

-

Capital Injection: Selling government properties injects billions of dollars (estimated $10 billion for DOT assets alone), which companies can use to finance new CRE projects and manufacturing facilities, expanding capacity and innovation.

-

Increased Development Activity: Divested properties often become available for commercial redevelopment, attracting developers and manufacturers to invest in renovation or new construction, which boosts local real estate markets.

-

Job Growth and Economic Activity: As private companies acquire properties to expand manufacturing or commercial operations, this spurs employment and economic growth in related industries like construction, real estate services, and supply chains.

-

Market Confidence: Government asset sales send positive signals of market liquidity and can improve investor confidence, further encouraging private sector investment in CRE and manufacturing.

Estimated Percentage Increase in Commercial Real Estate Sector

-

Empirical studies and market analyses suggest that such a capital influx and property availability can increase commercial real estate development and investment activity by 5% to 15% annually in affected regions, depending on local market conditions and the scale of sales.

-

Manufacturing expansion tied to newly available or upgraded real estate could see a 3% to 8% growth rate in output and employment due to improved infrastructure and capital access.

-

This growth potentially catalyzes a virtuous cycle, where enhanced CRE availability supports manufacturing expansion, and increased manufacturing demands new CRE development.

Government should not be afraid of “shrinkage” and although DOGE was a cookie cutter event that aided in addressing these issues of cost cutting, waste elimination and “abuse” that’s not what we’re projecting here. The DOGE project shocked Americans as to the abundant irresponsible spending of government. We don’t want shock and awe for Amercians, we want them happy that progress is being made by showing hard results through asset sales and liquid capital that promotes investment and development.

Recommendations for Asset Sales

-

Focus on Surplus and Underutilized Properties: Target properties that are not critical for mission operations, are underutilized, or can be consolidated to free up capital and reduce maintenance costs.

-

Enhance Transparency and Inventory Accuracy: Improve real property databases to clearly identify assets eligible for divestiture and optimize portfolio management.

-

Leverage Public-Private Partnerships (PPPs): Employ innovative sale-leaseback or joint development agreements to maintain operational capability while monetizing property.

-

Enviro-Social Considerations: Ensure sales align with environmental stewardship, cultural resource protection, and community impact to avoid negative externalities.

-

Prioritize High-Value Properties in Key Markets: Focus on properties with strong market demand, especially near urban centers, to maximize sale proceeds.

-

Invest Sales Proceeds in Mission-Critical Infrastructure: Use funds generated to modernize and upgrade remaining core assets and support agency missions more efficiently.

The federal government’s vast landholding offers substantial opportunities for strategic divestiture to generate revenue, streamline operations, and energize private sector development while balancing stewardship responsibilities.

Everyone in America, from teenagers to adults, understand that when you sell a piece of real estate, or a car – you got money to spend.

Asset sales or “positive shrinkage” similar to what grocery chains utilize in their deli and meat departments across the U.S. can be used to define CRE development and confidence, for departments like the DOT. This is an absolutely positive impact, not just for public and market sector, but to every day Americans that psychologically want to see shrinkage of government enterprise and in that downsizing you’re profiting, the market is profiting, companies are investing, and guess what – people may just crack a smile and give you a thumbs up for once.

Can you say UPSIDE?

Government, commerical, and civilian entity can work prosperously together, hand in hand, helping one another achieve a greater economy, while showcasing to the rest of the world how the American model of feedom and capital enterprise is definitely the superior choice!

I wish you all a very Happy Thanksgiving and I’ll see you back after the much needed time off for all of you out there.

God Bless & Baruch ata Adonai Eloheinu Melech Ha Olam.

Sources:

-

U.S. Department of Transportation Real Property Efficiency Plan FY20–FY24

https://www.transportation.gov/sites/dot.gov/files/2023-01/DOT%20Real%20Property%20Efficiency%20Plan%20FY20%20-%20FY24.pdf -

U.S. Department of Transportation Loan Portfolio and Managed Lanes Projects Update (FY2025)

https://www.transportation.gov/buildamerica/sites/buildamerica.dot.gov/files/2025-08/PortfolioReport_Q3_FY2025_web.pdf -

Nuvolo report on DOT Asset Management covering 87,000 properties (2024)

https://www.nuvolo.com/story/u-s-department-of-transportation-streamlines-asset-management-across-thousands-of-properties/ -

DOT Budget Estimates FY2026

https://www.transportation.gov/sites/dot.gov/files/2025-05/OST_FY_2026_Budget_Estimates_CJ.pdf -

FHWA Budget Estimates FY2025

https://www.fhwa.dot.gov/cfo/fhwa-fy-2025_budget_508.pdf -

Federal Transit Administration Value Capture Program (2025)

https://www.transit.dot.gov/valuecapture -

Reason Foundation Annual Transportation Finance Report 2025

https://reason.org/wp-content/uploads/annual-transportation-finance-report-2025.pdf -

FDOT Fiscal Year 2025-26 Budget Announcement

https://www.fdot.gov/info/co/news/2025/07012025 -

DOT FY2025 Budget Highlights

https://www.transportation.gov/sites/dot.gov/files/2024-03/DOT_Budget_Highlights_FY_2025_508.pdf -

Research on Transportation and Industrial Property Values (Oct 2025)

https://news.vt.edu/articles/2025/10/pamplin-transportation-industrial-property-values.html