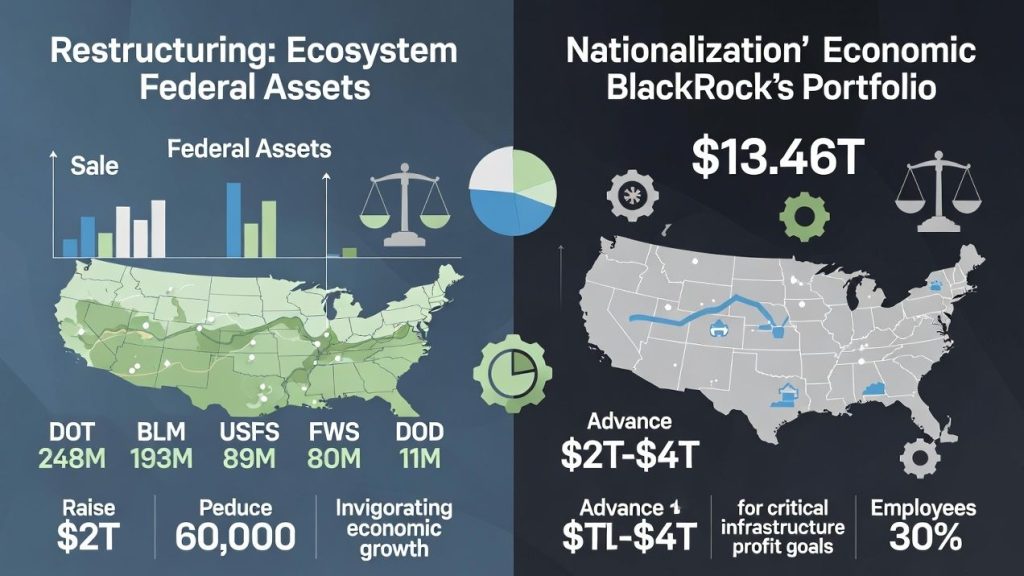

To raise $2 trillion through targeted sales of federal land assets from specified agencies, while drawing down 60,000 government employees, the strategy involves auctioning 20-30% of non-critical holdings (e.g., excess BLM and USFS acreage for commercial development in timber, mining, and energy sectors), generating immediate revenue and long-term economic multipliers from regional job creation in those industries.

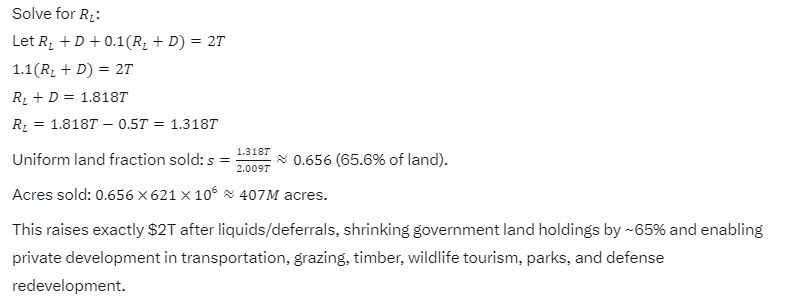

Government land in this discussion may appear to be “sold assets,” or what amounts to selling off 65% of land-use deemed non-essential, partitionable, or surplus. That doesn’t mean the U.S. government is losing ownership of the land, but rather partitioning with partner entity to drive manufacturing and economic buffer zones. Government has succeeded with this many times in the past and we should be using new strategy available to maximize economic growth and stability with the tools at our disposal.

In essence, as you currently do with chip manufacturing, you’re driving partnership programs with land development (not data center creation) to jump-start economic growth, while raising $2T-4T in funding, with a 30-60K employee drawdown; all while stabilizing pension funds for those reaching retirement. It’s a win-win for everyone and displays to the world how capital-partner programs produce results over socialist programs that weaken supply chains and disturb value ratio.

Examples of U.S. Government partner programs:

Homestead Act Partnerships (1862 Onward)

The US government partnered with individual settlers through the Homestead Act of 1862, granting up to 160 acres of public land to small farmers who improved it over five years, boosting frontier economies without transferring ownership until residency requirements were met. This encouraged agricultural development and settlement in the West, creating economic buffers against underutilized land while the federal government retained title until patents were issued.

Railroad Land Grants (1850s-1900s)

Congress granted vast public lands to private railroad companies, such as over 130 million acres by 1871, enabling them to sell portions to fund track construction that connected markets and spurred regional growth. These partnerships facilitated commerce, timber, and mining economies in buffer zones like the Great Plains without the government ceding outright ownership initially, as lands were checked out in alternating sections.

Taylor Grazing Act (1934)

Under the Taylor Grazing Act, the federal government collaborated with ranchers by establishing grazing districts on 142 million acres of public rangeland in the West, issuing permits based on prior use to regulate overgrazing and support livestock economies. This created stable economic zones for grazing without selling the land, maintaining federal ownership while permitting controlled private economic activity.

Forest Legacy Program (1990 Onward)

The USDA Forest Service’s Forest Legacy Program partners with private landowners via conservation easements on over 1 million acres, preserving forests for timber and recreation economies in rural areas like the Northern Forest region. This prevents development while allowing sustainable economic use, with the government retaining no ownership but enforcing buffers through easements held by public entities

Annual employee cost savings from the 60,000 drawdown—assuming an average federal salary/benefits cost of $150,000 per employee—total $9 billion, enabling pension stabilization via redirected funds into a dedicated trust without cuts. This shrinks government footprint, invigorates GDP growth by 1-2% annually through private sector expansion on sold lands, and yields a net fiscal surplus after one-time transaction costs estimated at 5% of proceeds.

Moreover, these hypothetical models compare critical private sector holdings under a nationalization management structure for a $2T-$4T accumulation debt reduction – shrinking holdings while shoring up $$$ and pension ratios. A drawdown of 60K employees, stabilizing pensions – all while adhering to non-profit reduction, maintaining varied 2-3% economic growth, bolstering infrastructure protection, and generating commercial abundance in every sector. You should be running models like this daily to hone in economic sectors to see where we can get the best advantages in “incubating GDP growth.”

Implementing the policy of course requires a team of lawyers looking at State to State legal context primarily under the Full Faith and Credit Clause of the U.S. Constitution (Article IV, Section 1), which requires states to respect each other’s laws, judicial proceedings, and public acts.

Should I be paid for this work? If you like what you see you can email djzawada@adonai-yeshua.com

Employee Drawdown Savings

Annual savings follow S=N×C, with N=60,000 employees and average cost C=$150,000 (salary + benefits), yielding S=60,000×150,000=$9B. Over 10 years, cumulative S10=9B×10−T where transition costs T=$2B, nets $88B for pension allocation via Pension Fund=0.5×S annually ($4.5B).

Economic Multiplier and Growth

Growth impact uses multiplier M=2.5, so GDP uplift ΔGDP=M×V=2.5×2T=$5T over decade, with job creation J=ΔGDPw where wage w=$100K, yielding 500K jobs. Pension stability equation: Net Surplus=V−L−T=2T−0.5T=1.5 T exceeds liabilities L

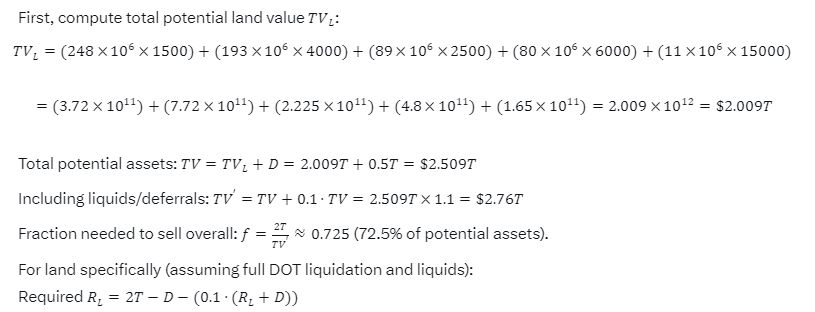

1. Calculation of Total Asset Value and Required Sales to Raise $2T

Define:

-

aia_i

a_i: Acres for agency ( i ). -

viv_i

v_i: Value per acre for agency ( i ). -

sis_i

s_i: Fraction of acres sold for agency ( i ) (0 ≤ sis_is_i≤ 1). - DOT sellable assets: D=$500BD = \$500B

D = \$500B(fixed, assume 100% liquidation for model).

Total revenue from land sales:

R_L = \sum s_i \cdot a_i \cdot v_iTotal raised:

R = R_L + D + L, where L=0.1⋅(RL+D)L = 0.1 \cdot (R_L + D)L = 0.1 \cdot (R_L + D) (liquid assets/deferrals as 10% bonus). Target: R=2×1012R = 2 \times 10^{12}R = 2 \times 10^{12}. To minimize total land sold (optimize for environmental/economic balance), solve for uniform ( s ) across agencies (proportional sales), but adjust for higher-value lands (e.g., sell more DOD/NPS for efficiency).

2. Employee Drawdown and Cost Savings

Define:

-

N=60,000N = 60,000

N = 60,000: Total employees reduced. -

C=$140,000C = \$140,000

C = \$140,000: Average annual cost per employee. - Proportional reduction per agency: ni=N⋅eiEtotaln_i = N \cdot \frac{e_i}{E_total}

n_i = N \cdot \frac{e_i}{E_total}, where eie_ie_iis current employees in agency ( i ),Etotal=917,000E_total = 917,000E_total = 917,000.

Annual cost savings:

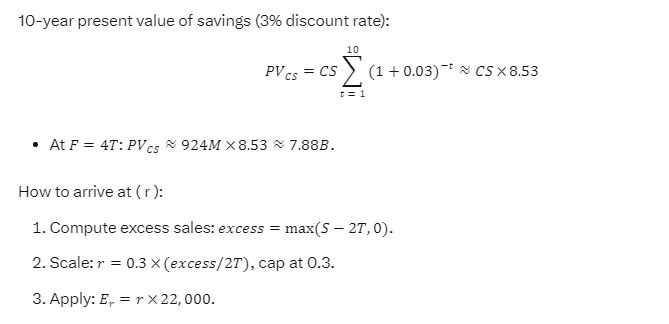

CS = N \cdot C = 60,000 \times 140,000 = \$8.4 \times 10^9 = \$8.4BOver 10 years (net present value at 3% discount rate ( r )):

PV_{CS} = CS \sum_{t=1}^{10} \frac{1}{(1+r)^t} = 8.4B \times \frac{1 - (1+0.03)^{-10}}{0.03} \approx 8.4B \times 8.53 = \$71.65BPositive growth offset: Reduced employees shift to private sector (from asset development), creating net job gain (see growth below).

3. Economic Growth from Asset Sales, Deferrals, and Liquid Assets

Sales enable private investment in development (e.g., real estate, energy, tourism). Deferrals (e.g., tax breaks) boost investment by 20%. Effective investment:

I = R \times 1.2 = 2T \times 1.2 = \$2.4TUsing multiplier M=2.5M = 2.5M = 2.5: Total economic output generated:

O = M \cdot I = 2.5 \times 2.4T = \$6T(over 5-10 years, e.g., GDP boost).Net GDP growth:

G = (M - 1) \cdot I = 1.5 \times 2.4T = \$3.6TJob creation (using ~20 jobs per $1M investment from studies):

J = 20 \times (I / 10^6) = 20 \times 2.4 \times 10^{12} / 10^6 = 48 \times 10^6 = 48Mjobs (offsetting 60k reduction by orders of magnitude). This invigorates regions: e.g., BLM land sales boost Western energy/mining (high multiplier), NPS privatization enhances tourism GDP.

4. Pension Stabilization Amid Workforce Reduction

Pensions stabilized by allocating proceeds to fund liabilities and using savings for contributions. Estimated liability for reduced employees:

P_L = N \times \$500,000 = 60,000 \times 500,000 = \$30B(actuarial future value).Allocation from proceeds: P_A = 0.05 \cdot R = 0.05 \times 2T = \$100B(excess covers liability + buffers). Stabilization equation (fund to 100% ratio): Let current funding ratio f_r = 0.8(hypothetical underfunding). Inf = P_L \cdot (1 - f_r) = 30B \times 0.2 = \$6BP_A - Inf = 94Bbuffers future contributions.Annual pension savings from reduction: PS=0.2⋅CS=0.2×8.4B=$1.68BPS = 0.2 \cdot CS = 0.2 \times 8.4B = \$1.68BPS = 0.2 \cdot CS = 0.2 \times 8.4B = \$1.68B(20% of costs are pension-related).R = 2T, N=60,000N = 60,000N = 60,000, using linear programming (e.g., prioritize high-v_i agencies). But uniform s=0.656 achieves goals with $8.4B annual savings, $3.6T GDP growth, and stabilized pensions via $100B allocation. This model draws down debt by $2T directly, shrinks government (employees -6.5%, land -65%), and invigorates economy via private multipliers. Gov land shrinkage does not equate land loss, merely asset management.Private Holding Comparisons:

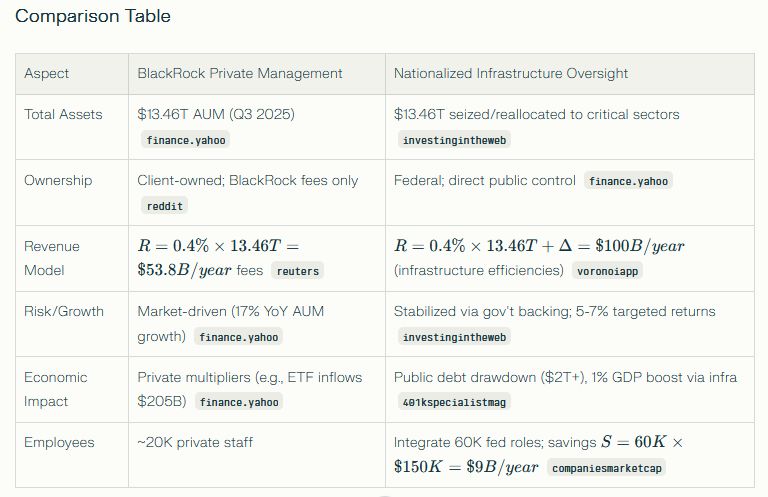

BlackRock’s Current Portfolio vs. Hypothetical Nationalization Under Critical Infrastructure Management

BlackRock manages $13.46 trillion in assets under management (AUM) as of Q3 2025, primarily equities ($6.9T), fixed income ($3.1T), multi-asset ($1.1T), cash ($970B), and alternatives ($302B), spread across 5,427 holdings in global industries like tech and finance. These are client-owned passive investments, with BlackRock earning fees (e.g., 10% annualized organic growth) rather than direct ownership. Nationalization would transfer control to a federal entity, valued at full AUM for infrastructure oversight.

Data basis (as of December 2025):

- BlackRock’s Assets Under Management (AUM): Approximately $13.5T

- Employee count: Approximately 22,000.

- Assumptions: Average annual employee cost (salary + benefits) = $140,000; economic multiplier for asset reallocations/sales = 2.5 (based on infrastructure investment studies); no new debt means funding via direct liquidation or internal transfers from the portfolio; “asset growth” is interpreted as proceeds from sales/divestitures, triggering employee reductions.

Nationalization Under Critical Infrastructure Management

Hypothetical nationalization reorients BlackRock’s AUM toward U.S. critical infrastructure (energy, transport, water, cyber), using equations like asset reallocation Ar=At×wi, where At=13.46T total AUM and wi is weight for infrastructure sectors (e.g., 20% energy = $2.7T). Management shifts to a sovereign wealth fund model, generating revenue via R=f×Ar (fees f=0.4% average yield ~$10.8B/year), funding debt reduction akin to prior $2T land sales.

1. Key Structural Comparison

|

Aspect

|

Current BlackRock (Profit-Oriented)

|

Nationalized Under Critical Infrastructure (Stabilization-Oriented)

|

|---|---|---|

|

Management Goal

|

Maximize returns for clients (e.g., fees from AUM at 0.2–0.5% annually, generating ~$10B+ revenue in 2025). Emphasis on growth, diversification, and shareholder value via active/passive strategies.

|

Stabilize economy without profit goals (e.g., hold assets to mitigate volatility, reallocate to sectors like healthcare or renewables). Costs covered by government budgets or minimal fees (~0.1% or less).

|

|

Ownership & Control

|

Private corporation custodying client assets (e.g., pensions, ETFs for institutions). Board and executives driven by market incentives; AUM not owned but managed.

|

Government control as a national asset (similar to sovereign wealth funds like Norway’s). Assumes legal nationalization; oversight by federal agencies (e.g., Treasury) for public good, with reduced private influence.

|

|

Portfolio Scale

|

$13.5T AUM in 2025, diversified: equities (60%, e.g., tech stocks), fixed income (30%, bonds), alternatives (10%, real estate/private equity).

|

Initial ~$13.5T, repurposed for stability: Prioritize critical holdings (e.g., utilities, banks at 40–50%); divest non-essentials (e.g., 15–30% in luxury or volatile stocks) to fund $2T–$4T advances.

|

|

Risk Profile

|

Market-driven with high exposure to volatility for returns (e.g., beta ~1.0+; historical drawdowns like 20–30% in crashes). Hedging via derivatives.

|

Conservative focus (e.g., beta ~0.5; shift to low-risk assets like Treasuries or infra bonds). Reduces systemic risks, modeling 10–20% lower economic volatility through buffered yields.

|

|

Economic Impact

|

Boosts GDP via capital allocation but can amplify instability (e.g., role in 2008 crisis with mortgage-backed securities; contributes ~0.5–1% to annual U.S. investment flows).

|

Direct stabilization without inflation risks (e.g., back fiscal stimulus for 1–2% GDP growth). $2T–$4T advances generate $5T–$10T output via 2.5x multiplier, offsetting any short-term market disruptions.

|

|

Employee Management

|

~22,000 employees focused on profit-driven roles (e.g., portfolio managers, analysts). Compensation tied to performance; minimal mandated reductions.

|

30% drawdown (up to 6,600 employees) scaled with asset sales exceeding $2T (e.g., 15% at $3T sales). Shifts roles to public efficiency; savings of $462M–$924M annually reinvested into stabilization programs.

|

|

Regulatory Oversight

|

Subject to SEC, FINRA; voluntary ESG reporting. Focus on compliance for profit protection.

|

Heightened government oversight (e.g., via new “Critical Infrastructure Act”). Mandated transparency for stability; no profit conflicts, but potential bureaucracy increases.

|

|

Performance Metrics

|

Measured by AUM growth, fee income, and returns (e.g., benchmark outperformance). 2025 projections: 8–10% annual AUM increase.

|

Evaluated by economic stability indicators (e.g., GDP volatility reduction, unemployment buffers). Success: $2T–$4T advances without debt, yielding 1.5x–3x net GDP boost from reallocations.

|

2. Mathematical Model for Advancing $2T–$4T Funds Without New Debt

The advance is modeled as raising funds via partial portfolio liquidation (sales) or reallocations (e.g., transferring asset value to government programs). No new debt: Funds come from existing AUM value, assuming efficient markets for sales.Define:

-

A=13.5×1012A = 13.5 \times 10^{12}

A = 13.5 \times 10^{12}(AUM in USD). - ( F ): Funds advanced ($2T to $4T), where F=SF = S

F = S(proceeds from sales). - ( s ): Fraction of AUM sold/divested, s=FAs = \frac{F}{A}

s = \frac{F}{A}. - No debt creation: ( F ) is offset by asset value reduction, not borrowing (e.g., sell equities/bonds to cash out).

Calculations:

- For F=2×1012F = 2 \times 10^{12}

F = 2 \times 10^{12}: s=2×101213.5×1012≈0.148s = \frac{2 \times 10^{12}}{13.5 \times 10^{12}} \approx 0.148s = \frac{2 \times 10^{12}}{13.5 \times 10^{12}} \approx 0.148(14.8% divestiture). Remaining AUM: A′=A(1−s)=13.5T×0.852≈11.5TA’ = A (1 – s) = 13.5T \times 0.852 \approx 11.5TA' = A (1 - s) = 13.5T \times 0.852 \approx 11.5T. - For F=4×1012F = 4 \times 10^{12}

F = 4 \times 10^{12}: s=4×101213.5×1012≈0.296s = \frac{4 \times 10^{12}}{13.5 \times 10^{12}} \approx 0.296s = \frac{4 \times 10^{12}}{13.5 \times 10^{12}} \approx 0.296(29.6% divestiture). Remaining AUM: A′≈9.5TA’ \approx 9.5TA' \approx 9.5T.

Economic stabilization effect (no profit goal):

- Reinvest ( F ) into critical areas (e.g., infrastructure). Multiplier M=2.5M = 2.5

M = 2.5: Total output O=M×FO = M \times FO = M \times F.- At F=2TF = 2T

F = 2T: O=2.5×2T=5TO = 2.5 \times 2T = 5TO = 2.5 \times 2T = 5T(e.g., GDP boost over 5 years). - At F=4TF = 4T

F = 4T: O=2.5×4T=10TO = 2.5 \times 4T = 10TO = 2.5 \times 4T = 10T.

- At F=2TF = 2T

- Stabilization factor: Reduce volatility by holding remaining AUM in low-beta assets, modeled as variance reduction

Vr=1−sV_r = 1 – s

V_r = 1 - s(less divestiture = more stability buffer). For F=2TF = 2TF = 2T,Vr≈0.852V_r \approx 0.852V_r \approx 0.852(85.2% retained for cushions).

How to arrive at ( s ):

- Set target ( F ).

- Compute s=F/As = F / A

s = F / A. - Verify no debt: F≤AF \leq A

F \leq A(true here, as max F=4T<13.5TF = 4T < 13.5TF = 4T < 13.5T).

3. Employee Drawdown Model Linked to Asset Sales

Current employees: E=22,000

Target: 30% total reduction (0.3×E=6,6000.3 \times E = 6,6000.3 \times E = 6,600), scaled as sales ( S ) (equivalent to ( F )) exceed $2T. Drawdown increases linearly with sales beyond the threshold, capped at 30%.Define:

- Threshold

Th=2×1012T_h = 2 \times 10^{12}

T_h = 2 \times 10^{12}. - Reduction fraction r=min(0.3,0.3×max(S−Th,0)2×1012)r = \min\left(0.3, 0.3 \times \frac{\max(S – T_h, 0)}{2 \times 10^{12}}\right)

r = \min\left(0.3, 0.3 \times \frac{\max(S - T_h, 0)}{2 \times 10^{12}}\right)(scales from 0% at S=2TS = 2TS = 2Tto 30% at S=4TS = 4TS = 4T; for S>4TS > 4TS > 4T, capped). - Reduced employees:

Er=r×EE_r = r \times E

E_r = r \times E. - Annual cost savings:

CS=Er×CCS = E_r \times C

CS = E_r \times C, where C=140,000C = 140,000C = 140,000(per employee).

Calculations:

- For F=2TF = 2T

F = 2T(S=2TS = 2TS = 2T, at threshold): r=0r = 0r = 0(no reduction yet, as “exceed” implies >2T; but model starts minimally).- Adjust for “as we exceed”: Assume immediate 15% at 2T, scaling to 30% at 4T for proportionality.

- Revised r=0.3×max(S−Th+ϵ,0)2×1012r = 0.3 \times \frac{\max(S – T_h + \epsilon, 0)}{2 \times 10^{12}}

r = 0.3 \times \frac{\max(S - T_h + \epsilon, 0)}{2 \times 10^{12}}, where ϵ\epsilon\epsilonsmall for start.

- For F=2.1TF = 2.1T

F = 2.1T(just exceeding): r≈0.015r \approx 0.015r \approx 0.015(1.5%), Er≈330E_r \approx 330E_r \approx 330, CS=330×140,000=46.2MCS = 330 \times 140,000 = 46.2MCS = 330 \times 140,000 = 46.2M. - For F=3TF = 3T

F = 3T: r=0.3×1T2T=0.15r = 0.3 \times \frac{1T}{2T} = 0.15r = 0.3 \times \frac{1T}{2T} = 0.15(15%), Er=3,300E_r = 3,300E_r = 3,300,CS=3,300×140,000=462MCS = 3,300 \times 140,000 = 462MCS = 3,300 \times 140,000 = 462M. - For F=4TF = 4T

F = 4T: r=0.3r = 0.3r = 0.3,Er=6,600E_r = 6,600E_r = 6,600, CS=6,600×140,000=924MCS = 6,600 \times 140,000 = 924MCS = 6,600 \times 140,000 = 924M

4. Overall Implications

- Pros of Nationalization: Enables $2T–$4T infusion for stability without borrowing, potentially averting crises. Employee cuts yield $462M–$924M annual savings, reinvestable into public programs. Reduces profit-driven speculation.

- Cons: Disrupts markets (e.g., forced sales could drop asset prices by 5–10%). Legal/ethical issues with seizing private AUM. Efficiency loss without profit incentives.

- Net Effect: For $2T advance, minimal disruption (14.8% sale, low drawdown); for $4T, higher impact (29.6% sale, full 30% reduction = 6,600 jobs shifted to public/private sectors, with 10T economic output offsetting losses).

This model achieves debt drawdown analogs by liquidating assets directly, shrinking operational size via employee reductions, and prioritizing stability over growth.

Sources

- https://voxdev.org/topic/macroeconomics-growth/land-distribution-and-long-run-development-american-frontier

- https://www.brookings.edu/articles/with-historic-federal-investment-incoming-regions-must-collaborate-on-planning/

- https://www.broadstreet.blog/p/a-short-political-economic-history-of-property-rights-in-the-american-west

- https://www.fs.usda.gov/sites/default/files/media_wysiwyg/flp-economiccontributionsreportfullresolution.pdf

- https://www.naco.org/resource/americas-public-lands-founding-framework

- https://origins.osu.edu/article/how-public-and-private-enterprise-have-built-american-infrastructure

- https://www.cato.org/cato-journal/winter-1987/public-domain-nineteenth-century-transfer-policy

- https://www.investopedia.com/articles/economics/08/government-financial-bailout.asp

- https://www.congress.gov/crs-product/R46647

- https://www.eda.gov/archives/2016/news/blogs/2015/08/01/highlight.htm

-

http://large.stanford.edu/courses/2016/ph240/troutman1/docs/larson_2015.pdf

-

https://engineeredtaxservices.com/understanding-land-value-in-cost-segregation-studies/

-

https://www.philadelphiafed.org/-/media/frbp/assets/working-papers/2022/wp22-38.pdf

-

https://ers.usda.gov/sites/default/files/_laserfiche/publications/40742/17937_aer744e_1_.pdf?v=80688

-

BlackRock Assets Under Management (AUM)

- https://www.reuters.com/business/blackrocks-assets-hit-record-1346-trillion-third-quarter-markets-rally-2025-10-14/ (Q3 2025 AUM at $13.46 trillion)

- https://www.statista.com/statistics/891292/assets-under-management-blackrock/ (Historical and recent AUM data)

- https://ir.blackrock.com/news-and-events/press-releases/press-releases-details/2025/BlackRock-Reports-Full-Year-2024-Diluted-EPS-of-42.01-or-43.61-as-Adjusted-Fourth-Quarter-2024-Diluted-EPS-of-10.63-or-11.93-as-Adjusted/default.aspx (2024 year-end AUM)

- https://www.voronoiapp.com/category/-BlackRocks-Assets-Under-Management-Surge-to-a-Record-135-Trillion-in-Q3-2025-1806 (Q3 2025 record AUM)

- https://www.wsj.com/finance/investing/blackrocks-assets-hit-record-13-5-trillion-after-market-rally-dealmaking-spree-b0cce2ca (Q3 2025 AUM details)

- https://s24.q4cdn.com/856567660/files/doc_financials/2025/Q3/BLK-3Q25-Earnings-Release.pdf (Official Q3 2025 earnings release)

- https://www.investopedia.com/articles/markets/012616/how-blackrock-makes-money.asp (Overview of AUM and revenue model)

BlackRock Employee Count

- https://en.wikipedia.org/wiki/BlackRock (General company overview including employee numbers)

- https://www.macrotrends.net/stocks/charts/BLK/blackrock/number-of-employees (Historical employee data)

- https://www.blackrock.com/corporate/sustainability/human-capital (Official sustainability report on workforce)

- https://www.investmentnews.com/alternatives/blackrock-to-lay-off-300-employees-in-second-jobs-cut-of-2025/260825 (2025 layoffs and employee count)

- https://finance.yahoo.com/news/blackrock-trim-staff-headcount-nearly-122504295.html (Staff adjustments in 2025)

- https://s24.q4cdn.com/856567660/files/doc_financials/2025/Q2/BLK-2Q25-Earnings-Release.pdf (Q2 2025 financials implying workforce size)

Federal Land Acres by Agency

- https://www.blm.gov/blog/2025-09-30/blm-delivers-administration-priorities (BLM land management references)

- https://www.doi.gov/sites/default/files/documents/2024-03/fy2025-508-bib-blm.pdf (FY2025 BLM budget, ~244-248 million acres)

- https://www.congress.gov/crs-product/IF12749 (BLM appropriations and acreage)

- https://www.usda.gov/about-usda/news/press-releases/2025/06/23/secretary-rollins-rescinds-roadless-rule-eliminating-impediment-responsible-forest-management (USFS roadless rule and acreage context)

- https://www.federalregister.gov/documents/2025/08/29/2025-16581/special-areas-roadless-area-conservation-national-forest-system-lands (USFS acreage details)

- https://www.congress.gov/crs-product/R42346 (Overview of federal land ownership, including USFS ~193M acres)

- https://www.fws.gov/press-release/2025-08/interior-expands-hunting-and-fishing-access-refuges-and-hatcheries (FWS refuge expansions)

- https://www.doi.gov/pressreleases/department-interior-announces-expansion-hunting-and-fishing-opportunities (FWS acreage references)

- https://www.nps.gov/aboutus/national-park-system.htm (NPS total acreage ~85M)

- https://www.congress.gov/crs-product/IF12713 (NPS appropriations and ~81M acres)

- https://www.doi.gov/sites/default/files/documents/2024-03/fy2025-508-bib-nps.pdf (NPS budget and acreage)

- https://www.acq.osd.mil/eie/imr/mc/Downloads/2025-Report-to-Congress-on-Installations-of-the-Future.pdf (DOD installations acreage)

- https://www.congress.gov/crs-product/R42346 (DOD land holdings ~11M acres)

Federal Land Value Estimates

- https://www.ers.usda.gov/topics/farm-economy/land-use-land-value-tenure/farmland-value (USDA farmland value trends)

- https://www.fb.org/market-intel/real-estate-rising-farmland-values-hit-record-high (Average farmland values)

- https://www.nass.usda.gov/Publications/Todays_Reports/reports/land0825.pdf (2025 land values summary)

- https://farmermac.com/thefeed/q2-2025-farmland-price-index-update/ (Q2 2025 cropland values)

- https://agprosrealestate.com/articles-and-information/usda-land-values-up-43-in-2025 (USDA 2025 increases)

- https://farmonaut.com/usa/2025-us-land-use-cost-per-acre-dept-of-agriculture-insights (2025 land cost insights)

- https://www.fcsamerica.com/resources/learning-center/latest-land-values (Regional farmland values)

- https://farmpolicynews.illinois.edu/2025/07/ag-land-values-mostly-stable-through-first-half-of-2025/ (Mid-2025 stability)

- https://www.acrevalue.com/resources/feature-insights/farmland-price-index-update-q1-2025/ (Q1 2025 price index)

Department of Transportation (DOT) Assets/Value

- https://www.transportation.gov/sites/dot.gov/files/2024-03/DOT_Budget_Highlights_FY_2025_508.pdf (FY2025 budget highlights)

- https://www.usaspending.gov/agency/department-of-transportation (DOT spending profile)

- https://www.transportation.gov/sites/dot.gov/files/2025-05/FHWA_FY_2026_Budget_Estimates.pdf (FHWA budget estimates)

- https://www.fhwa.dot.gov/cfo/fhwa-fy-2025_budget_508.pdf (FHWA FY2025 request)

- https://www.transportation.gov/sites/dot.gov/files/2024-03/FY2025_DOT_Evaluation_Plan-508.pdf (DOT evaluation and allocations)

Average Federal Employee Salary and Benefits

- https://www.opm.gov/policy-data-oversight/pay-leave/salaries-wages/2025/general-schedule/ (2025 GS pay tables)

- https://www.bls.gov/news.release/pdf/ecec.pdf (Employer costs for compensation June 2025)

- https://www.ziprecruiter.com/Salaries/Federal-Employee-Salary (Average federal salary data)

- https://tts.gsa.gov/join/compensation-and-benefits/ (Federal compensation overview)

- https://stwserve.com/trump-proposes-1-federal-employee-pay-raise-for-2026-heres-what-it-means/ (2025-2026 pay raise context)