Follow along as we develop new trade routes for U.S. business enterprise 2020 to 2028.

From 2023 Via: https://defencesecurityasia.com/ustda-submarine-cable-hexa/

(DEFENCE SECURITY ASIA) — The U.S. Trade and Development Agency (USTDA) has awarded a feasibility study grant to Malaysia’s Hexa Capital Consultancy (Hexa), to support development of the Malaysia-U.S. (MYUS) submarine fiber optic cable system.

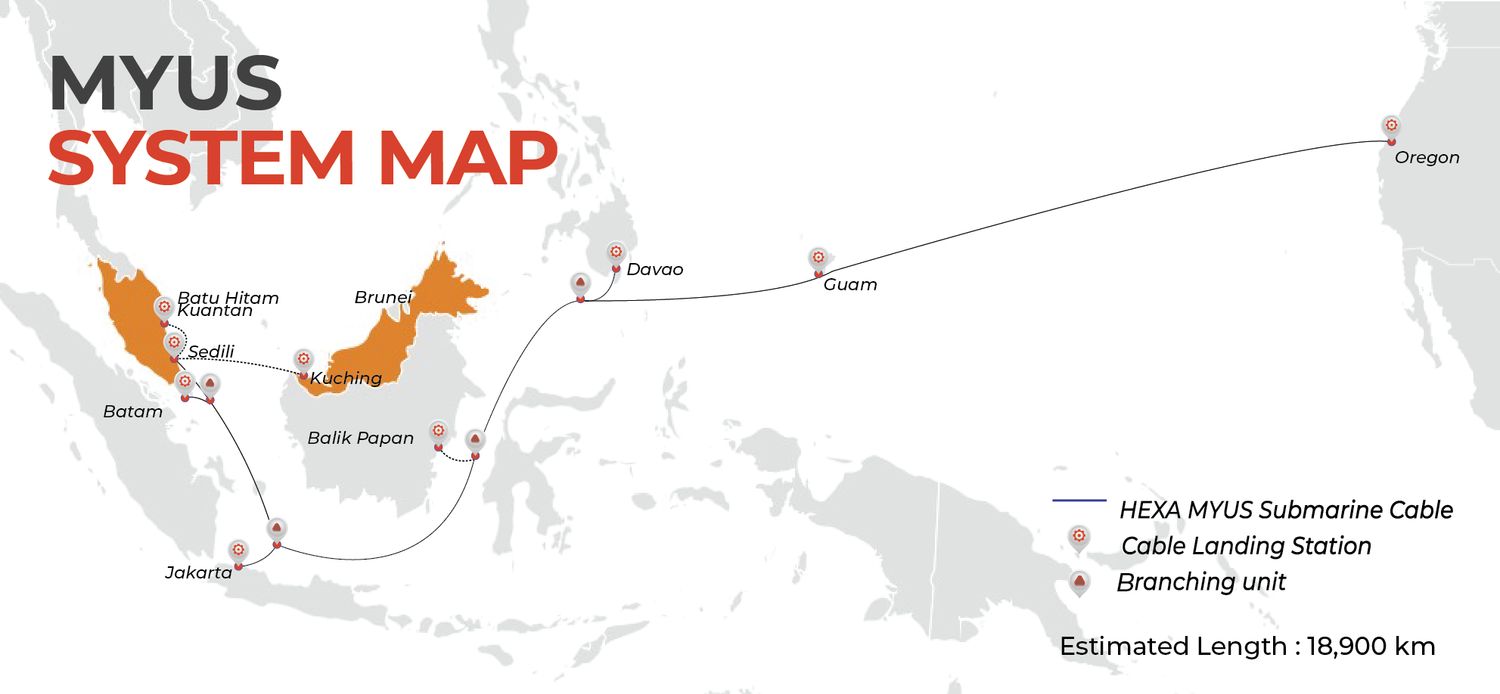

The MYUS cable will add cost-effective digital connectivity capacity by directly linking Indonesia, Malaysia, and the Philippines with the United States.

“This project will increase access to reliable and affordable digital services across Southeast Asia, including remote and underserved areas, while creating a secure communications link between the region and the United States,” said Enoh T. Ebong, USTDA’s Director.

“Implementation of the MYUS cable will also create business opportunities for U.S. companies to partner with Hexa on their ambitious transpacific project.”

Hexa selected Massachusetts-based T Soja & Associates, Inc., to conduct the study, which will provide Hexa with detailed plans to guide their project’s implementation.

The cable is expected to have a combined length of 19,221 kilometers with six landing stations in Southeast Asia and three in U.S. states and territories across the Pacific.

“MYUS will be the first international cable to have a direct connectivity from Malaysia to the United States, helping to support the implementation of 5G wireless services and further investment in data centers,” said Dr. Abang Azhari Hadari, CEO of Hexa.

“USTDA’s grant will be the cornerstone for us to start the MYUS project.”

“The United States is pleased to partner with Malaysia and support the expansion of Malaysia’s digital economy,” said Chargé d Affaires a.i. to Malaysia Manu Bhalla.

“This project will enable government, businesses, and other Malaysian stakeholders to securely access the Internet via a system created by trusted vendors.”

USTDA’s support for this project advances the digital pillars of the Partnership for Global Infrastructure and Investment and the Indo-Pacific Economic Framework.

The U.S. Trade and Development Agency helps companies create U.S. jobs through the export of U.S. goods and services for priority infrastructure projects in emerging economies.

USTDA links U.S. businesses to export opportunities by funding project preparation and partnership building activities that develop sustainable infrastructure and foster economic growth in partner countries. — DSA

The US Trade and Development Agency (USTDA) has awarded a feasibility study grant to Malaysia’s Hexa Capital Consultancy to develop what would be the first subsea cable system directly connecting Malaysia and the US.

Malaysia currently connects to 18 international subsea cable systems, but of those, only the Asia-America Gateway (AAG) club cable connects to the US.

Hexa says that the MYUS cable is expected to be just over 19,220 km with six landing stations in Southeast Asia, including Indonesia, Malaysia, and the Philippines. MYUS will also have three landing stations in US states and territories across the Pacific.

No details have yet been given about the MYUS cable in terms of planned capacity.

Hexa has already selected T Soja & Associates to conduct the study, which will provide Hexa with detailed plans to guide the project’s implementation.

USTDA director Enoh T. Ebong said in a statement that the MYUS cable would add cost-effective digital connectivity capacity and “increase access to reliable and affordable digital services across Southeast Asia, including remote and underserved areas, while creating a secure communications link between the region and the United States.”

Hexa CEO Dr. Abang Azhari Hadari added that the MYUS cable would help to “support the implementation of 5G wireless services and further investment in data centres.”

The grant was announced on the sidelines of the APEC CEO Summit in San Francisco.

Fast forward to November 2024,

By Winston Qiu

Hexa Capital Consultancy PLT (“Hexa”), owner of the Malaysia-U.S. (“MYUS”) cable system based in Malaysia, appointed Globe as its Philippines landing partner for the MYUS cable system, to land the cable in Davao city.

The MYUS cable system will be built with 16 fiber pairs along its backbone, and the infrastructure is scheduled to be finished by 2028. MYUS will provide the first direct fiber connectivity between Malaysia and the US, improving the speed of data transfer in Southeast Asia, including the Philippines.

The MYUS cable system will begin from the Malaysian Peninsula near Sedili and will cross to Davao and the US territory of Guam. The cable will travel onward to the landing station in Florence, Oregon, which is run by Alaska Communications.

In its path, the MYUS will connect to Batam, Jakarta and Balikpapan in Indonesia.

Hexa founder and CEO Azhari Abang Hadari said the subsea cable would accommodate mainly the connectivity demands of large-scale hyperscalers, state agencies and network providers.

Moreover, Azhari said MYUS would take on a route that avoids the disputed waters in Southeast Asia to ensure its operational sustainability.

Hexa selected Globe as its Philippine partner for MYUS as it expressed confidence that Globe can deliver its part on time and efficiently. Azhari cited Globe’s experience in putting up telco infrastructure such as the Philippine Domestic Submarine Cable Network (PDSCN).

Globe is a member of the consortium that built the $150 million PDSCN, jointly built with Eastern Communications and InfiniVAN Inc., being the longest domestic subsea cable in the Philippines.

According to Hexa, the initial capex set for the development of the MYUS cable project is approximately US$720million, to build the cable spanning more than 19,000 kilometers, containing 16 fiber pairs and designed with a minimum capacity of 15 Tbps per fiber pair..

In 2023, the US Trade and Development Agency (USTDA) awarded a financing grant to Hexa to support its initiative to connect Southeast Asia and the US by way of Malaysia.

Earlier this year, Hexa selected Alaska Communications and GTA as its landing partners for MYUS’ landing in Oregon and Guam respectively.

Hexa Appoints Alaska Communications as Landing Party for MYUS Cable in Oregon

Hexa Capital Consultancy PLT, Alaska Communications Press Release

September 11, 2024

ANCHORAGE, Alaska & KUALA LUMPUR, Malaysia–(BUSINESS WIRE)–Hexa Capital Consultancy PLT (“Hexa”), owner of the Malaysia-U.S. (“MYUS”) cable based in Malaysia, appointed Alaska Communications as its U.S. Landing Party for the Malaysia-US (MYUS) cable.

“Alaska Communications’ cable landing facilities in Florence include the beach landing, front-haul fiber and cable landing station built in 2008 for the Alaska-Oregon Network (AKORN) which was commissioned in 2009.”

“We look forward to a long-term relationship hosting MYUS at our premier landing station. Strategically positioned along the Oregon coast, our Florence landing station is a critical hub for subsea fiberoptic cables which are the backbone of today’s internet. This location provides unparalleled access to multiple fiber backhaul providers, ensuring seamless connectivity to major data center complexes in Seattle, Hillsboro, Silicon Valley and beyond. By hosting international cables, our landing station plays a vital role in driving global economic growth and enhancing access to education, healthcare, and overall quality of life. Our highly trained, experienced local team will act as strategic partners in operating MYUS, further demonstrating our leadership in global subsea cable management,” said Jeff Vogt, chief operating officer, Alaska Communications.

Project Status as of October 2025

- 2023-2024: Feasibility study completed, with partnerships established. Globe Telecom was selected as the landing partner in the Philippines, and Alaska Communications for the U.S. landing in Oregon.

- Early 2025: APTelecom was appointed to support commercialization efforts, focusing on capacity sales and network integration.

- Current Status: The project remains in the planning and commercialization phase, with no reported construction starts yet. It is on track for a ready-for-service (RFS) date in mid-2028, assuming no delays from regulatory, environmental, or geopolitical factors.

This aligns with broader trends in Southeast Asia, where multiple subsea cable projects (e.g., Candle, involving Malaysia) are underway to boost regional capacity amid rising data demands.

The MYUS cable is positioned as a U.S.-backed initiative to counterbalance Chinese influence in subsea infrastructure, emphasizing secure and reliable connectivity for underserved areas in Southeast Asia.

How the MYUS Cable Opens Up U.S. Business Influence and Facilitates Flow of U.S. GoodsSubmarine cables like MYUS play a critical role in expanding U.S. economic and strategic influence by improving digital infrastructure, which indirectly supports trade in both physical goods and digital services.

Enhanced connectivity reduces latency, increases bandwidth, and enables more efficient data flows, benefiting U.S. companies in tech, e-commerce, and content delivery. This creates a “new market” dynamic in Malaysia by making it easier for U.S. firms to penetrate and scale operations, particularly in a region where internet penetration and digital economy growth are accelerating.

In terms of U.S. goods flowing into Malaysia:

- Physical Goods: Better digital connectivity supports supply chain management, real-time inventory tracking, and e-commerce platforms, facilitating imports of U.S. products like electronics, machinery, and consumer goods. This is amplified by recent trade agreements (detailed below) that lower barriers.

- Digital Goods and Services: The cable enables seamless delivery of U.S.-originated content, software, and cloud services (e.g., from Amazon, Microsoft), creating pathways for “goods” like streaming media, apps, and data services to reach Malaysian consumers.

U.S. centrality in such cables contributes significantly to the American economy—up to $169 billion annually—by positioning U.S. firms as key providers in global data routes. csis.org

In Malaysia, this counters potential shifts toward Chinese infrastructure, strengthening U.S. alliances and market access.

Advertising Market OpportunitiesThe MYUS cable will enhance digital advertising by providing the bandwidth for high-quality, low-latency ad delivery, targeting, and analytics—key for U.S. giants like Google, Meta, and Amazon, which dominate global digital ads.

Malaysia’s digital advertising market is booming:

- Valued at approximately USD 450 billion in 2024, with a projected CAGR of 7.5% through 2030.

linkedin.com

- In 2025, digital ad revenues are expected to reach MYR 7.5 billion (about USD 1.7 billion), accounting for 78% of the total advertising economy, driven by mobile and programmatic ads.

- Digital out-of-home (DOOH) advertising is forecasted at USD 105.5 million in 2025.

statista.com

Improved connectivity via MYUS will allow U.S. companies to expand reach, with more Malaysian users accessing U.S.-hosted platforms. A recent U.S.-Malaysia trade deal further supports this by prohibiting digital services taxes (DST) on U.S. platforms, ensuring they retain full ad revenue without local levies.

Tariff Costs and Trade Facilitation

As of October 2025, a new U.S.-Malaysia reciprocal trade agreement has significantly reduced barriers for U.S. goods entering Malaysia.

Key highlights:

- Malaysia has eliminated or reduced tariffs on nearly all U.S. exports, covering over 1,700 product lines valued at USD 5.2 billion, including zero tariffs on specific U.S.-origin goods.

- The U.S. maintains a 19% reciprocal tariff on certain Malaysian imports but provides non-discriminatory market access for U.S. firms in digital trade and services.

- Effective dates vary (e.g., some from August 2025), with exclusions for select imports to ease compliance.

This deal addresses digital trade barriers, investment, and services, complementing the MYUS cable by ensuring U.S. goods, both physical and digital, face lower costs to enter the Malaysian market.

Combined, they position Malaysia as a more accessible hub for U.S. business expansion in Southeast Asia. Which means you can decompress from East Asian monopolized manufacturing.